The Employees Provident Fund (EPF) introduced a significant change to its member accounts on April 25, 2024, with the launch of Account 3, or also known as Account Flexible. This new account lets members under 55 manage their retirement savings with more flexibility, catering to their current needs. Unlike previous accounts, Account 3 allows members to withdraw funds anytime to address short-term financial needs.

With the introduction of Account 3, Malaysians have a powerful new tool for retirement planning. It empowers members with greater control over their savings. However, with this flexibility presents a challenge. Will this newfound flexibility ultimately provide a more secure retirement, or will it lead to unforeseen financial stress down the road?

What’s New?

Previously, EPF members had two accounts: Account 1 (retirement savings) and Account 2 (funds for housing and other approved withdrawals). Now, with the introduction of Account 3, members will have:

Opting-In for Initial Funds in Account 3

While Account 3 starts with a zero balance, EPF offers a one-time opt-in window between May 11 and August 31, 2024. This allows you to transfer a portion of your existing Account 2 balance to kickstart your Account 3.

If the member does not choose to opt-in for an initial amount, no transfer will be made, and the existing balance will remain in Account 2.

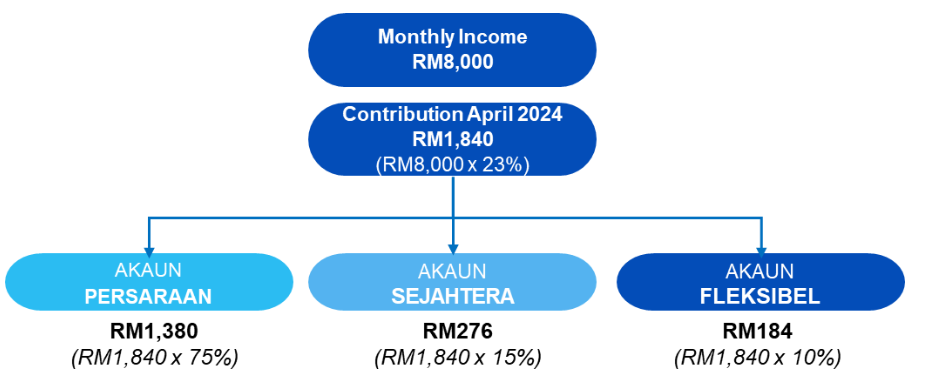

All contributions after 11 May 2024 will be allocated into the new accounts in the following manners: 75% into Account 1, 15% into Account 2 and 10% into Account 3.

Benefits of Account 3

Key Points to Consider for Account 3

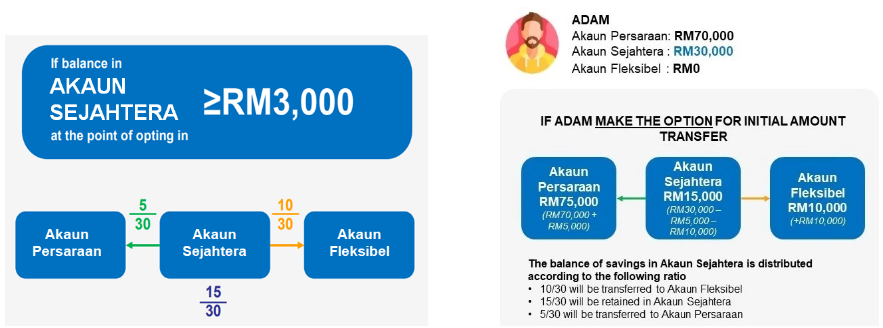

Account 3 will start with new contributions that will be credited to the member’s account after the implementation date. The initial transfer to Account 3 and other accounts is based on the balance of the individuals balance in Account 2 on the date the opt in application was made.

The transfer method is according to the breakdown below:

Balance in Account 2 of RM3,000 and above

Transfers will be made as follows:

• Ten out of thirty (10/30) of the balance in Account 2 will be transferred to Account 3;

• Five out of thirty (5/30) of the balance in Account 2 will be transferred to Account 1; and

• Fifteen out of thirty (15/30) will be retained in Account 2.

Source: EPF

Balance in Account 2 below RM3,000

Transfers will be made as follows:

• Account 2, with a balance of RM1,000 and below will transfer all amounts to Account 3.

• Account 2 with balance of more than RM1,000 and less than RM3,000, the amount transferred to Account 3 is RM1,000, while the remainder is retained in Account 2 .

• No distribution will be made to Account 1 for savings balance below RM3,000.

Account 2 with savings below RM1,000

Account 2 with savings of RM1,000 and below:

Source: EPF

The difference in this distribution method is to enable members with low savings balance to also have a meaningful initial amount in their Account 3.

What’s the dividend for Account 3?

As for now, the dividend for Account 3 remains the same as Account 1 and Account 2. However, according to EPF chief executive officer Ahmad Zulqarnain Onn said that while at present the dividends remained the same across all three accounts, this could change in the future.

Can you withdraw money from EPF Account 3 starting 11th May 2024?

Yes, it is true that EPF contributors will be able to withdraw from their Account 3 from as early as May 11, but only if they opt in between launch day and Aug 31. Members can make withdrawals from Account 3 at any time for any purpose, subject to a minimum withdrawal amount of RM50.

Applications for withdrawals from Account 3 can be made online through KWSP i-Akaun or at any EPF branches nationwide. Members who have yet to register with KWSP i-Akaun are encouraged to do so for withdrawal transactions from Akaun Fleksibel to be made.

Contribution Transfer

Source: EPF

Savings can only be transferred in one direction and cannot be reversed back into the original account. There is no limit on the amount that can be transferred between accounts.

Taking Charge of Your Future

Account 3 offers exciting flexibility, but as the proverb goes, “sedikit-sedikit, lama-lama menjadi bukit” (little by little, a hill is formed). Careful planning and responsible withdrawals are key to ensuring your retirement savings continue to grow steadily. Remember, the power to make informed decisions about your finances ultimately rests with you. Utilise this flexibility wisely, and your golden years will be all the brighter.